https://www.sama.sk.ca/property-owner-services/understanding-assessment/revaluations

2021 Assessment Information Sheet

The Assessment Notice is NOT a tax notice, and does not equal property tax. Assessment notices are sent annually to those property owners whose properties have changed in value. In a revaluation year, assessment notices are sent to every property owner on the municipal tax roll. At this time, the Council for the RM of Lake Lenore No. 399 has not established its tax policy for 2021, and property taxes are an unknown value for 2021.

Provincial legislation requires all properties in Saskatchewan be revalued once every four years. For the 2021 revaluation, the base date used for assessment values is January 01, 2019. This means that 2021 values reflect a property’s value as of January 01, 2019 not January 01, 2021. Revaluations update the market value of a property to a new base date; they are not a physical re-inspection of a property. To arrive at these values, SAMA conducts market research and uses industry standard valuation approaches.

Please note that in a revaluation year, Section 293 farm dwelling exemptions may not carry forward from land owned and/or leased or rented in adjoining municipalities. It is the responsibility of the property owner to ensure that all information is provided to our office regarding the assessment and ownership share of any lands in adjoining municipalities. The deadline to notify the Administration Office of these lands is March 31 annually.

New for the 2021 assessment year is the removal of Section 293 farm dwelling exemptions in unorganized hamlets. This is a legislated change, and is not under the control of council or administration. If you have any concerns about this change, please contact your MLA.

The 2021 assessment appeal period is open for 60 days, and closes at 4:00 on May 25, 2021. You may not appeal based on what your property taxes may calculate at; you may only appeal the valuation of your property. Appeals must be in the hands of the Administrator at the close of the appeal period; late arriving appeals will not proceed. If you are mailing your appeal to the Administrator, please allow sufficient time for Canada Post to deliver.

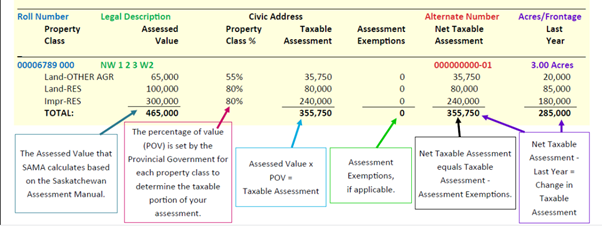

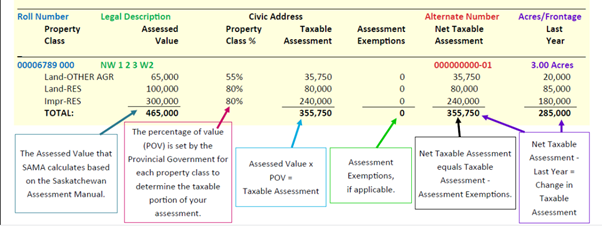

Understanding Your Assessment Notice

If you have any questions about your assessment notice, excluding questions about what your 2021 taxes will be, please call or stop by the Administration Office. Covid safety measures must be followed by anyone entering the Administration Office.

Frequently Asked Questions:

What is assessment?

Property assessment is the process of determining an assessed value for taxation purposes. Assessed value is not necessarily the selling price of your property or even what your insurance company or bank would consider the value of your property. Generally, the assessed value is now close to average market values for most types of property in the municipality. The calculations used to determine assessed value are based on the formulas, rules, and regulations set out by provincial legislation and the Saskatchewan Assessment Manual.

For more information on the calculation of assessed value, please visit the SAMA website (www.sama.sk.ca).

Additional information regarding Property Assessment and Taxation can be found on the Government of Saskatchewan website at www.saskatchewan.ca/residents/taxes-and-investments/property-taxes

Why would my property’s value change?

In addition to it being a revaluation year, fair values change for various reasons, such as:

- additions, upgrades, or other building changes have been recorded;

- buildings have been removed or replaced

- land subdivision has occurred.

Where do assessment appraisers get the information to calculate the fair value of my property?

The RM of Souris Valley No. 7 contracts SAMA to set values to properties within the municipality. Assessment appraisers review information about your property obtained from recorded property characteristics, building permits, site visits, land title information, maps, photos, and sales data. Using this information, they calculate your fair value assessment using a variety of appraisal techniques similar to what a realtor or appraiser would do. It must be remembered, however, that assessors must use mass appraisal and that all values must be fair and equitable with similar properties.

For more information and to view your property reports, please visit SAMAView at www.samaview.ca/sama/

If I am not satisfied with my assessment, what can I do?

Contact SAMA at 1-800-216-4427 and ask to speak to an assessment appraiser in respect to your property. They will explain how your assessment was determined and can once again confirm the accuracy of the records and explain the steps that need to be taken should changes be required. The assessment appraiser may also be able to provide you with other information that may assist you with your inquiry.

If I am still not satisfied after speaking with an assessor, what is my next step?

You can appeal your assessment to the Board of Revision. Appeals against an assessed value are only accepted for 60 days after the mailing of the assessment notice. The Board of Revision ensures that your assessment is fair and equitable. If you appeal your assessment and the Board makes a change, the decision changes the property assessment value in the year of assessment only and cannot be made retroactive to previous years.

When can I appeal my assessment?

Within 60 days of the assessment roll being advertised, you must give your completed notice of appeal to the Administrator. This can be done personally, by ordinary or registered mail, or by email. You must ensure that the appeal notice is in the hands of the Administrator before the close of the 60-day period.

Can I appeal my taxes?

- Provincial legislation outlines what are considered valid grounds of appeal. Property taxes or the mill rate are not valid reasons for appeal.

In late 2016 the 737 Fire Board was established. This led to the formation of the 737 Volunteer Fire Department in late 2017, which set to provide wildland fire fighting services to the residents and ratepayers of the RM of Souris Valley, RM of Lomond and a portion of the RM of Lake Alma. Since the establishment of the 737 Volunteer Fire Department the Councils of the RM of Souris Valley and the RM of Lomond have worked together to establish a fleet of equipment consisting of 4 fully equipped wildland fire fighting trucks and 2 water tenders.

In late 2016 the 737 Fire Board was established. This led to the formation of the 737 Volunteer Fire Department in late 2017, which set to provide wildland fire fighting services to the residents and ratepayers of the RM of Souris Valley, RM of Lomond and a portion of the RM of Lake Alma. Since the establishment of the 737 Volunteer Fire Department the Councils of the RM of Souris Valley and the RM of Lomond have worked together to establish a fleet of equipment consisting of 4 fully equipped wildland fire fighting trucks and 2 water tenders. Together we built and outfitted a brand-new fire hall in a central location and have recruited and continue to train around 30 active volunteer fire fighters. The fire department consists of a local fire chief as well as deputy fire chiefs from each municipality, working along side the volunteers that spread from the south end of the RM of Souris Valley to the north end of the RM of Lomond. The formation of the fire department has also prompted numerous discussions and meetings for multiple mutual aid agreements with all surrounding municipalities, United States counties and other fire/rescue departments. Through these actions the 737 Fire Department is able to provide emergency fire and specific rescue services to ratepayers and residents of both municipalities in addition to mutual aid to the neighboring municipalities and counties should the need arise.

Together we built and outfitted a brand-new fire hall in a central location and have recruited and continue to train around 30 active volunteer fire fighters. The fire department consists of a local fire chief as well as deputy fire chiefs from each municipality, working along side the volunteers that spread from the south end of the RM of Souris Valley to the north end of the RM of Lomond. The formation of the fire department has also prompted numerous discussions and meetings for multiple mutual aid agreements with all surrounding municipalities, United States counties and other fire/rescue departments. Through these actions the 737 Fire Department is able to provide emergency fire and specific rescue services to ratepayers and residents of both municipalities in addition to mutual aid to the neighboring municipalities and counties should the need arise.